In today’s digital age, eCommerce has become the go-to platform for businesses to expand their reach and boost sales. However, a crucial aspect of running an online store is the ability to securely process credit card transactions. With the rise in online fraud and the need for seamless transactions, businesses must understand the complexities of eCommerce credit card processing.

Whether you’re a small business owner just starting out or a seasoned eCommerce veteran looking to optimize your payment processing, this article will equip you with the knowledge and tools necessary to make informed decisions.

What is eCommerce credit card processing

This term refers to the system or technology allowing online businesses to accept credit card payments from customers. It involves secure capturing and transmitting customer payment information, verifying the transaction, and transferring funds from the customer’s credit card account to the merchant’s account.

Benefits of credit card processing in online shopping

eCommerce business owners and merchants have significant advantages when a ecommerce credit card payment system is integrated and works.

- Increased sales: Accepting payments with credit cards provides convenience for customers, leading to higher conversion rates and increased sales.

- Global reach: Online credit card processing enables businesses to reach customers worldwide, expanding their customer base and market reach.

- Faster payments: Credit card transactions are processed instantaneously, allowing businesses to receive payments quickly and improve cash flow.

- Enhanced security: Processing employs encryption and other security measures to protect customer data, reducing the risk of fraud and chargebacks.

- Improved customer experience: Accepting credit cards offers a seamless and convenient payment option for customers, enhancing their shopping experience.

If you don’t have credit card processing on your website, it means that you are not able to accept credit card payments directly from your customers. This can be a significant limitation as credit cards are one of the most common and convenient methods of online payment. Collaborating with a financial services provider can help you establish secure and efficient credit card processing, ensuring you meet your customers’ payment preferences.

Without credit card processing in eCommerce, you would need to rely on alternative payment options such as PayPal, Stripe, or other third-party payment gateways. These services act as intermediaries between your website and the customer’s credit card, handling the payment processing for eCommerce securely.

Integrating a robust e-commerce credit card payment system is pivotal for ensuring a seamless and versatile payment experience for your online customers who want to sell online conveniently.

How Does eCommerce Credit Card Processing Work?

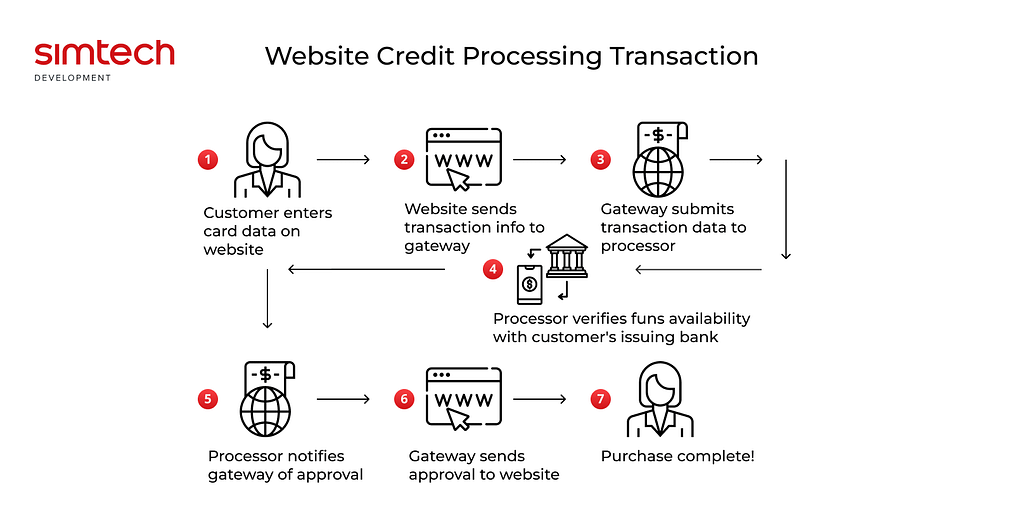

Understanding how eCommerce credit card processing works is essential for anyone involved in running an online business. It allows you to securely accept and process payments from customers, ensuring a smooth and efficient eCommerce transaction process. Basically, the online credit card payment processing works through a series of steps:

- The customer selects products and proceeds to checkout on the merchant’s website.

- At checkout, the customer enters their credit card details, including card number, expiration date, and CVV code.

- The eCommerce merchant processing system ensures that the merchant’s website securely transmits the customer’s payment information to the payment gateway.

- The eCommerce credit card payment gateway encrypts and transmits the payment data to the credit card processing companies.

- The credit card processing company verifies the transaction details with the customer’s issuing bank to ensure sufficient funds and validity.

- The customer’s bank then collaborates with the issuing bank to approve or decline the transaction and sends the response back to the credit card processor.

- The processing company relays the response to the payment gateway, which then communicates the result to the merchant’s website.

- If approved, the funds are transferred from the customer’s credit card account to the merchant’s account.

Online credit card payments: Pricing, Fees and Charges

Online credit card transactions involve various pricing components, fees, and charges that businesses need to consider, including potential hidden fees that may not be immediately apparent. Let’s explore these aspects with some examples:

- Payment Provider Fees: Payment service providers typically charge fees based on different factors, including processing fees. For instance, Stripe, a popular payment gateway, charges the following fees for businesses in the United States:

- Transaction Fee: 2.9% + $0.30 per successful transaction

- Chargeback Fee: $15 (refundable if the dispute is resolved in your favor)

- International Card Fee: Additional 1% for cards issued outside the United States

- Merchant Account Fees: eCommerce merchant account providers have their own fee structures. For example, PayPal, a widely used eCommerce merchant account provider, offers the following fees for businesses in the United States:

- Transaction Fee: 2.9% + $0.30 per successful transaction

- Chargeback Fee: $20 (non-refundable)

- Cross-Border Fee: Additional 1% for international transactions

- Interchange Fees: Interchange fees are set by credit card networks and vary depending on factors such as card type and online transaction method. Here are some examples of interchange fees for eCommerce Visa and Mastercard transactions in the United States:

- Visa: Interchange fees range from 1.43% + $0.05 – $2.40 depending on the card type and transaction details.

- Mastercard: Interchange fees range from 1.55% + $0.10 – $2.60 depending on the card type and transaction details.

- Chargeback Fees: Chargeback fees are imposed by credit card networks and acquiring banks. For instance, eCommerce credit card charge with Visa and Mastercard is as follows:

- Visa: $15 per chargeback

- Mastercard: $15 per chargeback

- Cross-Border Transaction Fees: Cross-border transaction fees are charged for international transactions. For example, Stripe charges an additional 1% for cards issued outside the United States, as mentioned earlier.

- Currency Conversion Fees: Currency conversion fees are applied when converting the customer’s currency to the merchant’s currency. PayPal charges a currency conversion fee of 3.5% when converting a foreign currency into the merchant’s currency. At the same time, Stripe’s conversion fee is only 1%.

It’s essential for businesses to carefully review and understand the specific fee structures of eCommerce merchant account providers to make informed decisions about their payment processing needs and to manage their overall eCommerce merchant fees effectively.

Additionally, it’s important to consider other factors like volume discounts, recurring payments, monthly minimums, and any additional features or services that may incur extra fees. Carefully evaluating these pricing components will help you make informed decisions and manage the costs associated with online credit card transactions effectively.

Ensuring that your efforts to sell online remain both cost-effective and competitive, it’s crucial for merchants to be aware of and account for these eCommerce credit card processing fees in their ecommerce operations.

How to Choose eCommerce Credit Card Processor

Choosing the right eCommerce credit card processing service is crucial for the success of your online business. Here are some factors to consider when selecting a credit card processor:

eCommerce Credit and Debit Cards Fraud Prevention and Security

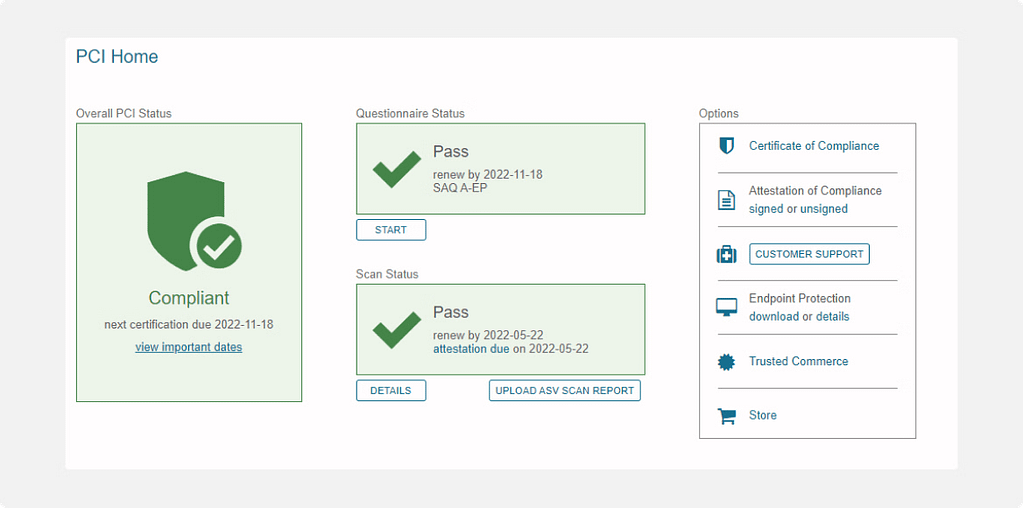

Look for a processor that prioritizes security and offers robust fraud prevention measures. Ensure they are compliant with Payment Card Industry Data Security Standard (PCI DSS) requirements and provide encryption and tokenization to protect sensitive customer data.

For Jackpykeshop we made the store compliant with PCI and literally saved their business from PayPal limitations.

Read more:

3DS-2: How Does 3D Secure 2.0 Impact Your CS-Cart …

Integration and Compatibility

Consider the compatibility of the credit card processing system with your eCommerce platform or website. Look for processors that offer seamless integration options, plugins, or APIs that make it easy to connect and process payments.

Pricing and Fees

Compare the pricing structures and fees of different eCommerce credit card processors. Look for transparency and clarity in their fee structures, including processing fees, monthly fees, chargeback fees, and any other applicable charges. Consider your business volume and transaction patterns to determine the most cost-effective payment solution.

Payment Methods

Ensure the processor supports the online payments that your customers prefer. Apart from credit and debit cards, consider whether they support alternative ways of payment like digital wallets (e.g., Apple Pay, Google Pay), bank transfers, or other popular regional payment options. Also, verify the accepted payment methods to ensure they align with your target audience’s preferences.

Read more:

6 Best Marketplace Payment Solutions In 2023

Customer Support

Evaluate the level of customer support provided by the credit card processing company. Consider their availability, response times, and the channels through which you can reach them (phone, email, live chat). Prompt and reliable customer support is essential for resolving any issues or concerns that may arise.

Reporting and Analytics

Look for processors that provide comprehensive reporting and analytics tools. These features can help you track sales, understand customer behavior, and make data-driven decisions to optimize your eCommerce operations.

Reputation and Reviews

Research the reputation and reviews of different credit card processing companies. Look for feedback from other businesses in your industry to gauge their experience with the processor. Consider factors like reliability, uptime, and overall customer satisfaction.

Scalability and Growth Potential

Consider the scalability and growth potential of the eCommerce credit card processor. Will they be able to handle increasing transaction volumes as your business grows? Can they support international payments and expansion if that’s part of your future plans?

Additional Services

Some credit card companies offer additional services like recurring billing, subscription management, invoicing, or multi-currency support. Assess whether these additional services align with your business needs.

Contract Terms and Flexibility

Review the contract terms and ensure they are reasonable and flexible. Look for processors that offer month-to-month contracts or have reasonable termination clauses in case you need to switch providers in the future.

Taking the time to evaluate these factors and compare different credit card processors will help you make an informed decision that aligns with your business requirements and goals. Consider reaching out to multiple processors, requesting demos or trials, and asking for references to gain deeper insights before making your final choice.

Popular eCommerce credit card processors

These are the widespread services that allow businesses to accept payments online. They provide secure payment processing services, fraud protection, and integration with popular eCommerce platforms and content management systems (CMS).

Standalone services

One of the best eCommerce credit card processing providers is Stripe. It offers a developer-friendly API that allows businesses to easily integrate eCommerce payment process into their websites or applications. It supports various programming languages and provides extensive documentation and resources for developers. Stripe also offers features like recurring billing, mobile payments, and international payment support.

Content Management Systems In-Built Solutions

In addition to standalone services like Stripe, popular CMS platforms such as Shopify, BigCommerce, and CS-Cart also offer built-in eCommerce payment processing solutions. These platforms provide a user-friendly interface for setting up and managing online stores, including integrated payments through built-in payment gateways that facilitate online sales. For example, CS-Cart offers integration with various payment gateways, allowing merchants to accept payments securely. Some of the popular payment gateways supported by CS-Cart include PayPal, Stripe, Authorize.Net, 2Checkout, and many more. These integrations enable businesses to accept credit card payments from customers and process transactions seamlessly.

CS-Cart also provides a user-friendly interface for managing payment settings, configuring payment methods, and handling transactions. Merchants can set up multiple payment types and customize the eCommerce checkout process according to their requirements. Additionally, CS-Cart offers advanced features such as secure payment tokenization, fraud prevention tools, and PCI DSS compliance to ensure the security of customer payment information, making it a reliable choice for businesses seeking an eCommerce payment processor.

How to accept credit card payments

Choose a Payment Gateway

Research and select a payment gateway that suits your business needs. Consider the options presented above. Ensure that the payment gateway you choose supports online transactions in the countries and states where you plan to operate your online store or marketplace.

Set Up a Merchant Account

Apply for a bank account as a merchant. The approval process may involve a credit check and review of your business model. Ensure that the merchant account allows you to accept payments from customers in the regions where you intend to do business.

Comply with State Regulations

Different countries and states may have specific regulations and requirements for accepting credit card payments through a payment service. For example, in California, businesses must comply with the California Consumer Privacy Act (CCPA) when handling customer data. In New York, businesses may need to adhere to the Stop Hacks and Improve Electronic Data Security (SHIELD) Act. Familiarize yourself with the regulations in each state to ensure compliance.

Implement Secure Payment Processing

Integrate the chosen payment gateway into your online store or marketplace. Ensure that the payment processing is secure and compliant with industry standards, such as Payment Card Industry Data Security Standard (PCI DSS), to protect customer payment information.

Test and Launch

Test the payment processing system to ensure it functions smoothly and securely. Once everything is set up and tested, you can launch your online store or marketplace, allowing customers from the selected states to make credit card transactions for their purchases.

How to Prevent eCommerce Credit Card Fraud?

Preventing fraud is essential to protect your business and your customers. Here are some strategies to help you minimize the risk of fraud:

- Use Address Verification System (AVS): AVS compares the billing address provided by the customer with the address on file with the credit card issuer. Implement AVS to ensure that the billing address matches the address associated with the credit card.

- Require CVV/CVC Codes: CVV (Card Verification Value) or CVC (Card Verification Code) are three-digit security codes printed on the back of credit cards. Require customers to provide this code along with their payment details during the checkout process to add an extra layer of verification.

- Implement 3D Secure: 3D Secure is an additional authentication layer that adds an extra step to the checkout process. It requires customers to enter a password or one-time code to verify their identity. Implementing 3D Secure for both credit and debit card payments can help reduce the risk of fraudulent transactions.

- Monitor and Analyze Transaction Patterns: Keep an eye on transaction patterns and look for any unusual or suspicious activity related to online purchases. Set up alerts or automated systems to flag transactions that deviate from normal patterns, such as high-value orders from new customers or multiple transactions from the same IP address.

- Use Fraud Detection Tools: Consider using fraud detection tools or services that analyze transaction data to identify potential fraud. These tools use machine learning algorithms to detect patterns and anomalies that may indicate fraudulent activity.

- Educate Your Staff: Train your staff on how to identify and handle potential fraudulent transactions. Teach them to look for red flags like mismatched billing and shipping addresses, unusual order quantities, or suspicious customer behavior.

- Keep Software and Systems Updated: Regularly update your eCommerce platform, payment gateway, and other software to ensure you have the latest security patches and features. Outdated website software can be vulnerable to security breaches and attacks.

- Secure Your Website: Implement SSL (Secure Sockets Layer) encryption on your website to protect customer data during transmission. Display trust seals and security badges to reassure customers that your website is secure.

- Limit Fraudulent Payment Options: Be cautious about accepting high-risk payment methods or orders from countries known for high levels of fraud. Consider implementing restrictions or additional verification steps for these types of transactions.

- Maintain Data Security: Follow best practices for data security, such as storing customer data securely, using strong passwords, and regularly monitoring and auditing your systems for vulnerabilities.

- Stay Informed: Stay updated on the latest fraud trends and techniques. Stay informed about new fraud prevention technologies and strategies to ensure you are taking proactive measures against evolving fraud tactics.

Remember that no system is foolproof, and it’s important to find a balance between preventing fraud and providing a smooth customer experience. Implementing a combination of these strategies, along with robust payment solutions, can help you reduce the risk of eCommerce credit card fraud and protect your business and customers.

Read more:

- Website hacked: Symptoms Your CS-Cart/Multi-Vendor is at risk

- 7 Tricks & Remedies for Hackers’ Protection: Cybersecurity

- Performance Testing: You Need to Think Critically

- How to Protect Your eCommerce Website on Holidays

- Why Should You Not Mix Email And Web Hosting Providers?

Conclusion

eCommerce credit card processing is a crucial aspect of running an online business. It allows businesses to expand their customer base, increase sales, and improve overall customer satisfaction. However, it’s important for businesses to carefully review and compare fee structures, security measures, and integration options before choosing a payment processor.

It is important not only to select a secure payment processing provider for online business, but to choose a reliable IT agency that will implement this integration without losses. With the right credit card integrator in place, businesses can focus on growing their online presence and providing a seamless shopping experience for their customers.