Setting the right price for your product is one of the most critical decisions in any business. It directly affects your profits, sales volume, and brand image. Price determines how customers perceive your value and whether they choose you over a competitor.

If you price too low, you may struggle to cover costs or grow sustainably. If you price too high without backing it up with value, you risk losing potential customers.

Poor pricing leads to shrinking margins, weak demand, and a confused market position. Getting it right is essential for long-term success in the eCommerce industry.

Dive into our detailed guide on how to price a product to set your winning strategy. We’ll show you how to apply pricing for profit principles to stay competitive without undercutting your margins.

What Is Product Pricing and Why It Matters

Pricing a product is a critical financial decision. It is a strategic move that defines how your brand enters the market, positions itself, and grows.

A price tag reflects the value and builds perception. When set correctly, it helps to attract the right target audience. Also, it fuels your business engine.

Product pricing is the process of determining the price a buyer is willing to pay for a product or service. It sits at the core of the business model. A price too low, and you are running on fumes. Too high, and you are losing sales. The right price keeps your business sustainable while staying competitive.

For example, a handmade candle business can’t compete with mass retailers on price. But it can win by offering premium packaging, unique scents, and positioning itself as a luxury gift item. The price reflects more than just wax. It reflects brand value.

Key Pricing Terms and Formulas

Before you run numbers, you need to know what they mean:

- Cost Price: The amount it costs you to produce or acquire the product.

- Selling Price: What your customer pays.

- Markup: The amount you add to the cost price.

- Profit Margin: The percentage of your selling price that’s profit.

Use this formula to calculate markup: Markup = (Selling Price – Cost Price) / Cost Price × 100

Use this to calculate profit margin: Profit Margin = (Selling Price – Cost Price) / Selling Price × 100

These are not the same. A 50% markup results in a 33% profit margin. Many confuse these terms, but they’re calculated differently.

A clear selling price formula helps you ensure profitability while staying competitive in your market.

Selling price vs. cost price

This is where many new entrepreneurs get confused. Put simply, the cost price covers expenses while the selling price covers the profit, business overhead, and future growth.

Example: you make a tote bag for $10. If you sell it for $12, your profit is $2. That is only a 16.6% margin. Not enough to market the product and reinvest in it. You need to think beyond the cost when setting your price.

Basic pricing formulas you should know

Here are three essential formulas to help you determine the price of a product quickly and accurately:

- Break-Even Price = Fixed Costs / Number of Units + Variable Cost per Unit

- Selling Price = Cost Price + Markup

- Profit = Selling Price – Total Cost

If you spend $5 per unit and want a 50% markup, your selling price becomes: $5 + ($5 × 0.5) = $7.50

Keep these simple formulas handy when modeling different scenarios.

Factors to Consider When Pricing Your Product

Before setting a final price, you need to look beyond costs and formulas. Several key factors influence what customers are willing to pay and what keeps your business profitable. These elements help you find the balance between value, demand, and sustainability.

Fixed and variable costs

Variable costs change with production that involves raw materials, labor, packaging. Fixed costs remain the same covering rent, salaries, and software. Combine both to understand your minimum pricing threshold.

Profit margin goals

Define your target margin from the beginning. For example, many eCommerce brands aim for a 30–50% margin to stay healthy. Luxury brands may aim for 60% or more of their sales.

Competitor pricing and market expectations

Research competitors in your niche. Do not blindly copy their prices. Instead, ask why they charge what they do. A $20 t-shirt and a $60 one may have similar materials but target a different audience.

Customer perception and value

Price is a signal. A low price may scream “cheap.” A high price should say “quality.” Align your pricing with the value you offer and a buyer persona you want to attract.

International fees and shipping

If you plan to expand globally with your store, consider the costs associated with taxes, payment processing fees, and international shipping. A $30 product could cost a customer $50 after all add-ons are applied. You should strive to maintain the highest level of transparency.

Popular Product Pricing Strategies

You should not expect a one-size-fits-all approach to pricing. The right strategy depends on your product, industry, and target audience. Below are the most commonly used pricing models, each with its strengths and challenges.

Cost-plus pricing

The cost-plus pricing strategy involves adding a fixed percentage to your cost. The good thing about it is that it is predictable and straightforward. The downside is that it doesn’t take into account demand or competition.

Value-based pricing

In this model, the price is based on the value your customer gets, not your cost. If the product solves a big pain point, customers are willing to pay more. This makes value-based pricing a strong choice for both products or services that deliver measurable outcomes.

Example: A SaaS tool that saves 10 hours of work per month can easily charge $29 or more, even if it costs $2 to deliver.

Competitor-based pricing

Your price is based on what others charge. Some businesses also use price matching to stay competitive and build customer trust in saturated markets..

Risk: you may stop innovating and lose your pricing power.

Dynamic pricing

With dynamic pricing, you may adjust the price based on real-time customer demand, maximizing profit during peak interest and remaining competitive during slow periods. Airlines, hotels, and eCommerce giants commonly use this pricing method. Requires solid analytics and automation tools.

Tiered and freemium pricing models

The idea is to offer multiple pricing levels. Entry-level options attract price-sensitive buyers, while premium tiers cater to higher-grade shoppers. SaaS companies use this strategy to convert free users into paid ones.

Subscription and flat-rate pricing

It works excellent for recurring revenue. Predictable income enables you to plan and scale effectively. You can utilize tiered subscription levels to appeal to various customer segments.

How to Price a Product: Step-by-Step Guide

To price your product successfully, follow a structured process that combines cost analysis, market research, and strategic thinking to inform your pricing decisions. A web scraping API can help collect competitor pricing and market data to make more informed decisions. With a structured approach, you can set a price for a product that covers your costs, meets your profit goals, and aligns with market expectations.

Follow these steps to build a price that makes sense for your business.

Add Up Your Variable Costs

These are the costs that vary depending on the number of units you produce or sell. They include materials, packaging, direct labor, transaction fees, and shipping (if you cover it).

Example:

If you sell handmade candles:

- Wax: $2

- Wick: $0.30

- Glass container: $1

- Packaging: $0.50

- Card processing fee: $0.60

- Shipping: $3

Total variable cost per unit: $7.40

Tip: Always track your actual spending for each unit. Even small overlooked items (like labels or padding) can reduce your profit. Accurately accounting for every cost is key to maintaining a healthy profit margin on each sale.

Calculate Your Break-Even Point

The break-even point indicates the number of units you must sell to cover all your costs. It helps you understand your minimum sales goal. Make sure you include your overhead costs in the fixed cost calculation to avoid underpricing.

Formula:

Break-even units = Fixed Costs / (Selling Price – Variable Cost per Unit)

Example:

- Fixed costs per month: $2,000

- Selling price: $20

- Variable cost per unit: $7.40

Break-even = $2,000 / ($20 – $7.40) ≈ 157 units

Tip: Use break-even analysis to set revenue goals or forecast different scenarios.

Choose Your Profit Margin

Profit margin is the percentage you add on top of your costs to make money. Set a target that reflects your business goals and market position. To do this effectively, you’ll first need to calculate product cost to know your baseline.

Example:

If variable cost is $7.40 and you want a 60% margin: Selling price = $7.40 / (1 – 0.60) = $18.50

Tip: Avoid arbitrary markup. Align your margin with your product’s perceived value and what competitors charge.

Factor in Fixed Costs

Fixed costs stay the same regardless of how much you sell. They include rent, utilities, software, salaries, and marketing tools. The markup should cover these.

Example:

Monthly rent, website hosting, and cold email platform = $1,500

If you sell 500 units per month, add $3 per unit ($1,500 ÷ 500) to your price.

Tip: Review your fixed costs quarterly to ensure accuracy. Eliminate expenses that don’t drive value.

Analyze Your Competitors

Look at what others in your niche charge. Study product quality, features, branding, and customer feedback. Use this to position yourself whether you want to compete on price, value, or uniqueness. If you choose to implement competitive pricing, make sure your product still stands out through branding or added value.

Example:

If competitors charge $30 for a similar fitness tracker, and your product has better battery life and design, you can justify pricing it at $35–$40.

Tip: Do not just copy competitor prices. Focus on what sets you apart.

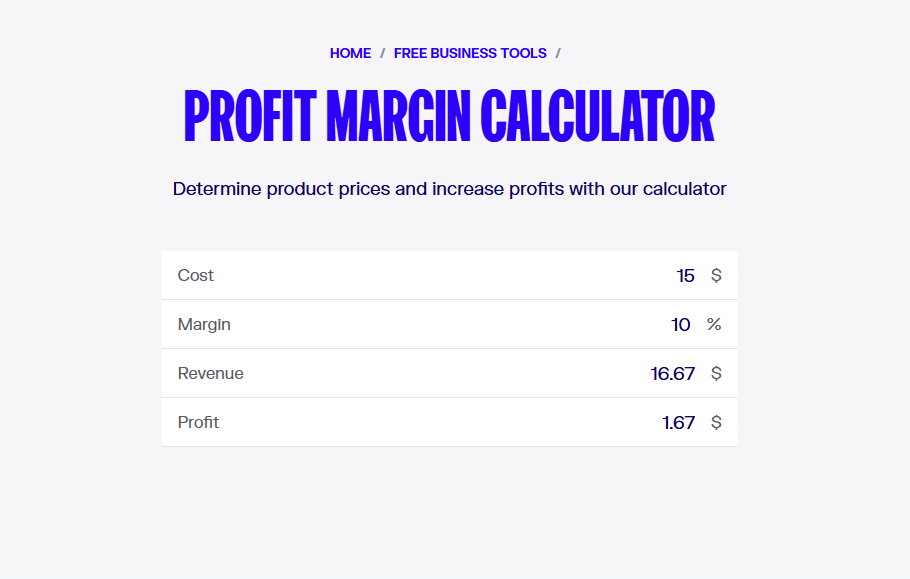

Use a Product Pricing Calculator

If you’re unsure how to price your product, pricing calculators can automate cost breakdowns and simulate profit scenarios to help you determine the optimal price. Many online tools enable you to input fixed and variable costs, margins, and sales targets. These calculators are handy when you need to determine pricing for a product without creating complex spreadsheets.

Tip: Use calculators to test different pricing strategies before launch. Run scenario-based models to see how changes affect profit. Some sellers also rely on US proxies to safely gather competitor pricing data from region-restricted websites or marketplaces.

Adjust Your Price Based on Demand

Once your product hits the market, track performance. If demand is high and customers see value, you may be underpricing. If you’re not converting, test whether the price or the offer is off.

Example:

After launching a course for $49, it sells out in two days. That is a signal to raise the price, for example, to $69 or $99, while adding more content or support.

Tip: Start with a soft launch. Use early sales data to adjust before scaling.

Pricing by Product Type and Sales Channel

Different products and sales channels require different pricing approaches. What works for a physical product in retail does not always fit a digital service or a subscription model.

Tailoring your pricing to your product type and where you sell it helps you stay competitive and profitable.

How to price physical products for retail

How do retailers usually price physical products? Many follow the keystone pricing rule: retail price = 2 × wholesale price.

Example: You sell handmade mugs for $10 wholesale. Retail price = $20.

How to price services and digital products

The approach is based on outcomes. A web designer can charge $500 or $5,000 depending on impact. One needs to use time, expertise, and client results to justify the price. When you price a service, also consider how your solution compares to alternatives and the savings or results it delivers.

Discover how to effectively price service projects with this guide, comparing time and materials vs. fixed price contracts.

Bulk and wholesale pricing

The idea is to offer volume discounts. This is where you might need to create clear pricing tiers. It’s also a practical way to price items in large volumes while still preserving profitability.

Example: 1-10 items = $10 each, 11-50 = $8 per item, 51+ = $6.

Subscription pricing models

With this model, you need to keep focus on monthly value. Make it cheaper than buying individually. Offer free trials to reduce friction.

Pricing for online marketplaces vs. your own store

Marketplaces charge a fee (e.g., Amazon, Etsy). You can raise prices slightly to offset this. On your site, you may offer lower tags or bundle more value.

How to Communicate Your Price to Customers

Even the best price will not work if customers cannot see the value behind it. How you present your price affects how people feel about your product.

Use proven techniques to effectively highlight benefits, establish trust, and make the cost appear reasonable.

Pricing psychology: anchoring and charm pricing

Use anchoring. In simpler words, show a higher price next to your offer to create contrast. Use charm pricing. For instance, $9.99 feels cheaper than $10.

How to show value, not just a number

You need to highlight benefits, not features. Show how your product saves time, makes money, or solves a problem. Use social proof, reviews, and case studies.

How to Handle Discounts and Promotions

Discounts can boost sales, attract new customers, and clear out inventory. However, they work only when used with purpose. Poorly planned promotions can harm your brand or train customers to expect deals.

Use discounts strategically to grow your business without sacrificing long-term value. Well-timed offers can also help you retain existing customers, in addition to attracting new ones.

When to discount and when not to

Do not train customers to wait for sales. Avoid offering deep discounts that compromise the perceived value.

Promotions that don’t damage your brand

Use bundle deals, limited-time offers, or free shipping instead of slashing prices. With the right eCommerce merchandising tactics, you can present these offers in a way that feels premium, not cheap. Offer loyalty rewards to retain customers without racing to the bottom.

How to Test and Optimize Your Pricing

Markets change, customer behavior shifts, and your business evolves. Testing and refining your price helps you stay competitive and maximize profit. Use real data to make smart adjustments instead of guessing.

A/B testing different price points

Split your audience. Test two prices for the same product. Measure which converts better.

Using sales data to inform pricing

Examine conversion rates, cart abandonment rates, and customer feedback. Identify patterns and friction points.

How to measure pricing ROI

Track revenue, customer lifetime value, and acquisition cost. High prices with high churn may cost more long-term.

When to raise or lower your prices

Increase prices when demand outpaces supply or when you add more value. Lower prices only if you reduce features or costs.

Tools for monitoring performance

Use tools like Google Analytics, Hotjar, or ProfitWell to monitor pricing performance over time.

Common Mistakes in Product Pricing

Even great products can fail if priced poorly. That’s why building a thoughtful product pricing strategy is just as important as product development. Many entrepreneurs lose money or miss growth opportunities because of avoidable pricing errors.

When you are aware of the most common mistakes, you protect your margins, attract the right customers, and stay ahead of the competition.

Underpricing to stay competitive

New businesses underprice their products to attract customers or beat the competition. While this may generate some sales, it often results in razor-thin margins or even losses. Over time, the business can’t scale, reinvest, or even pay the owner fairly.

Low pricing attracts bargain hunters who may not become loyal customers. It may also win short-term market share, but at the cost of long-term brand positioning and profitability. It also positions your product as low-value, which can negatively impact your long-term brand perception.

How to avoid it:

- Focus on value, not just price. Communicate what makes your product better.

- Set prices that ensure long-term sustainability. Ensure you cover all costs and still earn profit.

- Test slightly higher prices. Often, buyers accept them if the value is clear.

Ignoring total costs and overhead

You calculate your price based solely on materials and labor, ignoring monthly expenses such as rent, software, web hosting, payment processing, and shipping platforms. Taxes and marketplace fees are also left out.

Your “profitable” price loses money when these costs hit your bank account. Be sure to include not only fixed and indirect expenses but also your cost of goods sold when setting prices.

How to avoid it:

- List all business expenses including yearly or one-time ones. Then, allocate a portion per unit.

- Include tax and payment fees when calculating selling price.

- Use a full-cost pricing model to capture your actual cost per unit.

Pricing based only on competition

If you check your competitors’ prices and simply copy them without understanding their costs, audience, or positioning, you risk misaligning with your business model. You may offer better value and still charge less, or offer less and charge more. Both situations may confuse buyers.

How to avoid it:

- Study your competitors for reference, but set your price based on your costs, value, and goals.

- Understand what customers like and dislike about competitor products.

- Use competitor pricing as a benchmark, not a rule.

Forgetting to review and update prices regularly

You keep your original price even as supplier costs, shipping fees, or software subscriptions increase. The profit slowly disappears. Inflation and supply chain disruptions can erode margins quickly. If you don’t adjust, your business can become unsustainable.

How to avoid it:

- Review your pricing every 3–6 months.

- Track cost changes and update prices accordingly.

- Inform customers in advance when raising prices—transparency builds trust.

Not aligning pricing with brand positioning

You price a product too low or high without matching the message your brand sends. The customer sees a mismatch between your price and what they expect from your design, tone, or positioning.

Inconsistent pricing can confuse or turn off potential customers. For example, a premium brand with a bargain-bin price can feel suspicious.

How to avoid it:

- Define your brand clearly: Are you affordable, premium, or exclusive?

- Set prices that match the story you’re telling.

- Use design, copy, and customer service to support your pricing level.

Always review your pricing decisions with a clear understanding of your costs, brand identity, and customer expectations.

Pricing Tools and Calculators

Smart pricing starts with accurate calculations. Instead of guessing numbers on paper, use specialized tools that save time and reduce errors. These calculators help you determine the right price based on your costs, target margin, and business model.

1. Oberlo Markup Calculator

Designed for dropshipping, the Oberlo tool helps you apply consistent markups across different products. You enter your cost, and the system calculates the final retail price based on your specified markup percentage.

It’s ideal for businesses that manage many SKUs and want quick pricing consistency.

2. ProfitWell by Paddle

For digital services and SaaS companies, ProfitWell provides advanced analytics and pricing optimization solutions. It helps you identify revenue leaks, find your best-performing customer segments, and test different pricing models (like monthly vs. yearly plans).

It works well for subscription-based businesses and startups scaling in competitive markets.

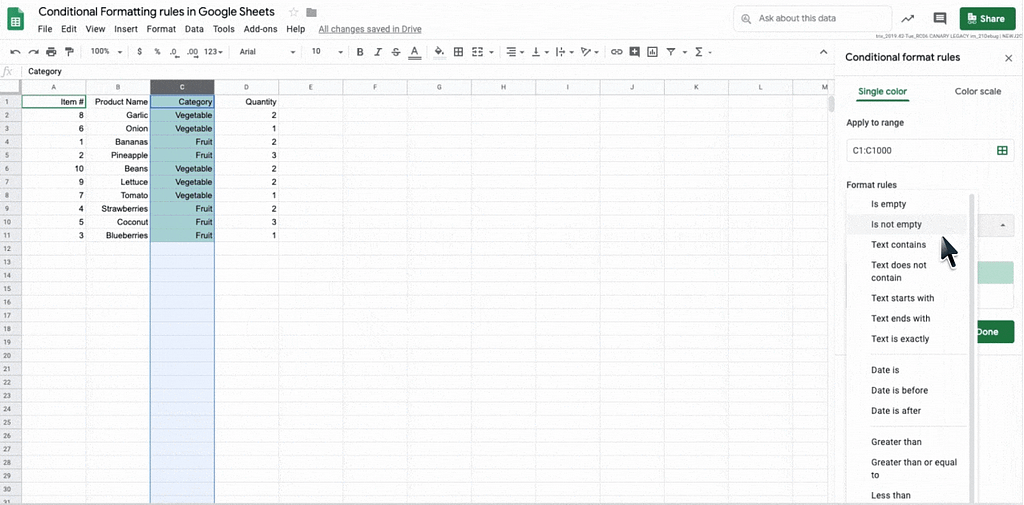

3. Google Sheets with Custom Formulas

If you want complete control, building your calculator in Google Sheets is a flexible option. You can create custom fields for fixed costs, variable costs, fees, taxes, and target margins.

With a few basic formulas, you can create a pricing sheet tailored to your business model. It’s beneficial for founders who like experimenting with different pricing strategies or forecasting different scenarios.

Conclusion

Pricing a product is an ongoing process of testing, learning, and adapting. Start with the numbers, but don’t stop there, as you also need to factor in value, perception, and positioning. The best way to price a product is to combine financial accuracy, market awareness, and customer insight. Charge with confidence. Your price should reflect not only the cost, but also the impact. Use this pricing guide as a reference whenever you launch a new product or revisit your pricing strategy.

Product Pricing FAQs

How to calculate product price manually?

Add your variable cost + fixed cost per unit + desired profit. Example: $10 + $2 + $3 = $15.

How to price digital goods?

Use value-based pricing. Since there’s no per-unit cost, base the price on how much the solution is worth to your customer.

What’s a good profit margin for retail?

Aim for 30–60%. Higher margins give you room for promotions and growth.

How often should I update my pricing?

Quarterly or when significant costs change. Also, after customer feedback, new competitors, or product updates.

How do I price a new product if I don’t have sales data yet?

Start by calculating your costs and desired profit margin, then research similar products in your niche. Use competitor pricing and perceived value to set an initial price, and be ready to adjust based on feedback and demand.