The constant development of eCommerce has led to the fact that the cryptocurrency payment method was introduced much earlier and has already proven its safety for both entrepreneurs and their customers. In this article, we will talk in detail about how to accept crypto payments on your eCommerce website, be it an online store or a marketplace.

Why Accept Crypto in Your Online Store?

- Attract new customers and untapped segments;

- Lower transaction fees;

- Avoid chargebacks;

- Enable borderless payments.

What Are Crypto Payments and Why They Matter

Cryptocurrency payments enable customers to pay for goods and services using digital assets like Bitcoin, Ethereum, and other tokens. As eCommerce evolves, crypto payments are gaining traction due to lower fees, faster settlements, and a decentralized structure that appeals to modern consumers.

With growing demand for secure, borderless transactions, supporting crypto in your online store or marketplace is becoming a strategic advantage—especially in industries driven by innovation, privacy, and speed.

Crypto Payment Prospects for an eCommerce Business in 2025

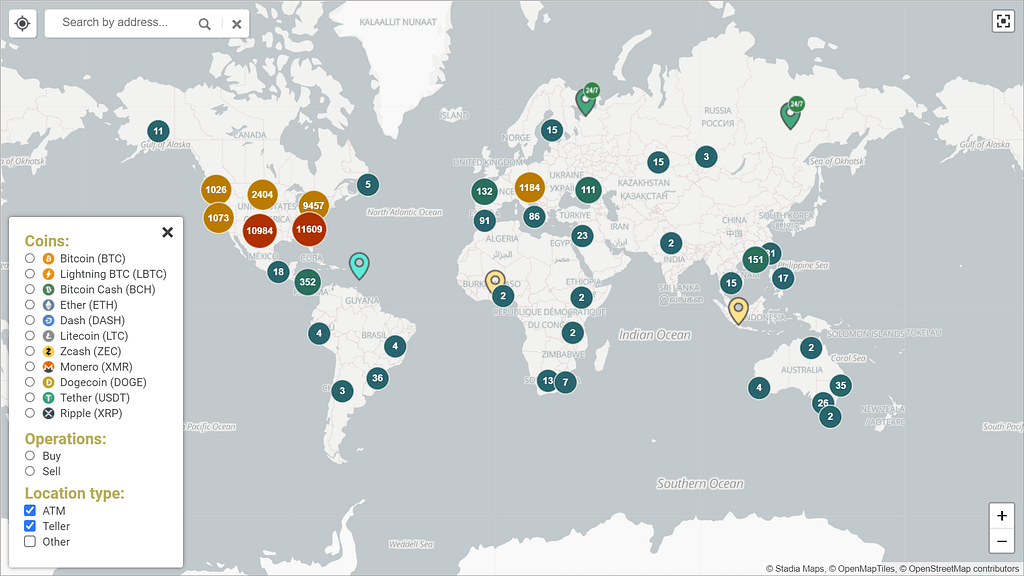

According to Google Trends, the interest in cryptocurrencies is still high. For this reason, the number of automatic telling machines that are located around the world is also growing.

As of April 2025, there are approximately 38,000 cryptocurrency ATMs worldwide (Statista, Binance, Coinflip). The majority of them are located in the United States, which hosts over 80% of the global total, while other regions such as Europe, Australia, and Canada are experiencing growth in installations. The vast majority of crypto ATMs support Bitcoin, with many also offering Litecoin, Ethereum, and other cryptocurrencies. Technology-conscious business owners are aware of the growing demand to support crypto payments and are looking for solutions to accept Bitcoin and other popular tokens as a means of payment.

The use of cryptocurrencies is booming for one more good reason – the more payment options an online shop or marketplace provides for customers, the more profitable the business is. After all, you can attract a new target audience, which for various reasons prefers payment only with digital currency, or increase the conversion rate.The shift toward decentralized payments is especially relevant for international markets where traditional financial systems are slow or unreliable.

In addition to ensuring secure financial transactions, it’s equally essential to protect your customers’ privacy and data while they shop or manage digital assets online. Many eCommerce businesses that accept cryptocurrency opt to integrate privacy-enhancing solutions, such as reliable VPN services. Choosing from the best VPN options can help keep both buyers and sellers secure against cyber threats when accessing sensitive crypto wallets or conducting cross-border operations. Accept payment in crypto to meet the growing demand for private and secure transactions in global eCommerce.

Benefits of Accepting Cryptocurrency in eCommerce in 2025

As crypto adoption rises, bitcoin for business is becoming a go-to payment method for innovation-driven companies.

- Borderless payments. Accept payments from any country without relying on local banks or currencies.

- Lower transaction fees. Crypto transactions often cost significantly less than credit card fees.

- Fewer chargebacks. Cryptocurrency payments are irreversible, eliminating fraud-related chargebacks.

- Expanded audience. Attract crypto-savvy buyers and privacy-conscious customers.

- Quick settlement. Payments are processed within minutes once confirmed on the blockchain.

- Crypto-friendly checkout. More flexibility for customers who prefer to pay with cryptocurrency.

Risks and Challenges of Accepting Crypto

Cryptocurrency Volatility and How to Handle It

Prices of digital assets can fluctuate significantly. Many merchants mitigate this by:

- Using payment gateways that offer instant conversion to fiat (government-issued money that is not backed by a metal);

- Settling crypto balances daily to avoid exposure.

Legal and Regulatory Considerations

Cryptocurrency regulations vary by country. Merchants should:

- Verify if they are allowed to accept crypto in their jurisdiction;

- Choose a gateway provider compliant with local KYC/AML requirements.

Taxation: What You Should Know

Crypto is often treated as property or currency, depending on the country. Track conversions and consult an accountant to ensure proper reporting.

Which Businesses Benefit Most from Crypto Payments?

Crypto payments aren’t ideal for every store—but for some, they can drive meaningful impact:

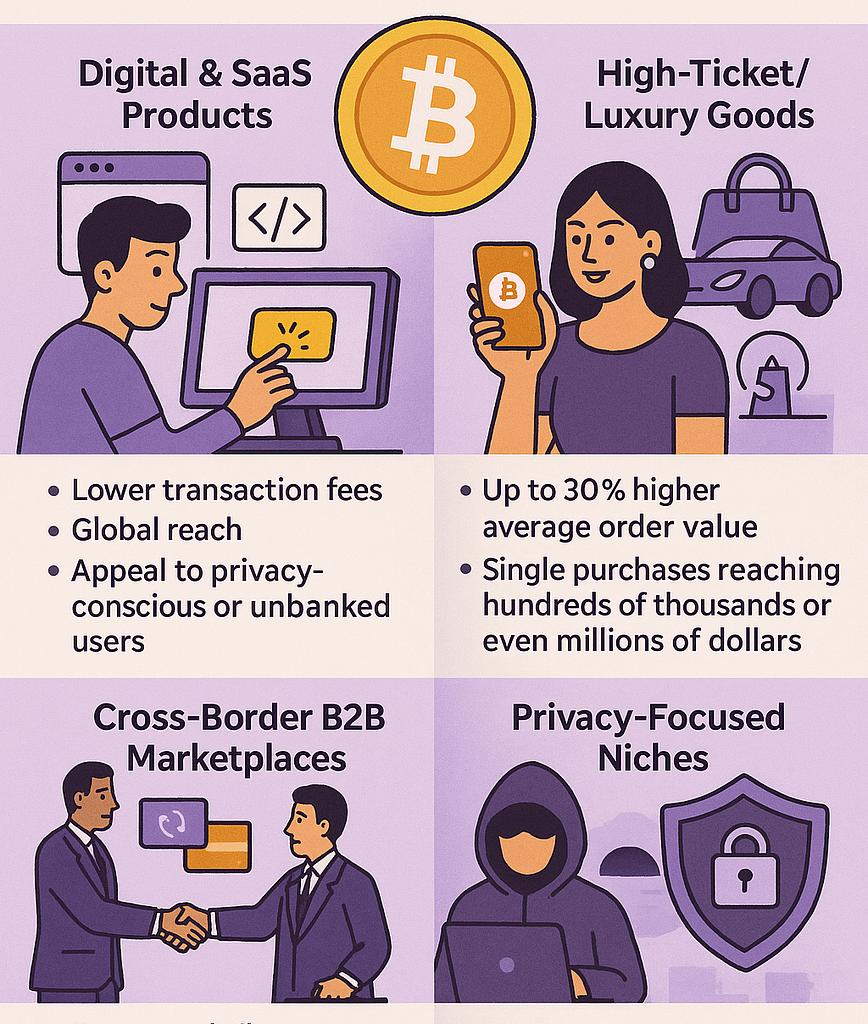

Digital & SaaS Products

Crypto enables instant, borderless transactions, making it ideal for digital subscriptions, software licenses, and downloadable products. Payment gateways like Cryptomus and DePay support recurring payments and easy integration, which is especially attractive for SaaS models and digital marketplaces.

Impact: Lower transaction fees, global reach, and appeal to privacy-conscious or unbanked users.

High-Ticket/Luxury Goods

Luxury brands (e.g., Gucci, Ferrari, Hublot) increasingly accept crypto to attract affluent, tech-savvy customers and crypto “whales.” Crypto payments offer exclusivity, fast settlement, and eliminate chargeback fraud.

Impact: crypto customers tend to spend more—sometimes up to 30% higher average order value compared to traditional payments. Some luxury retailers report crypto sales comprising up to 10% of transactions, with single purchases reaching hundreds of thousands or even millions of dollars.

Cross-Border B2B Marketplaces

Crypto streamlines international B2B payments by bypassing traditional banking barriers, reducing fees, and enabling near-instant settlement. This is especially valuable for industries with frequent cross-border transactions or those operating in regions with underdeveloped banking infrastructure.

Impact: faster cash flow, lower operational costs, and easier access to new markets. Crypto also enables fractional and micropayments, which are difficult with legacy systems.

Privacy-Focused Niches

Sectors like VPNs, cybersecurity, and “freedom tech” cater to users who value anonymity and data security. Accepting crypto aligns with their customers’ expectations for privacy and reduces the risk of payment censorship.

Impact: attracts privacy-minded clientele and those in regions with restrictive financial systems.

Choosing the Right Cryptocurrencies to Accept

Start with popular and well-supported coins:

- Bitcoin (BTC) is the most widely recognized;

- Tether (USDT) and USDC are stablecoins that are ideal for transactions as they are pegged to the US dollar;

- TON offers low fees and has active communities;

- Ethereum (ETH), the largest altcoin by market capitalization, is preferred for digital goods and NFTs due to its support for smart contracts that enable automated transactions.

Most crypto gateways let you enable multiple currencies and display pricing in crypto or fiat.

Simtech offers expert NFT marketplace development, enabling you to launch your own platform for selling digital assets, from artwork to collectible sports cards.

How Crypto Payments Work: The Processing Workflow

The process of paying with cryptocurrency is typically straightforward:

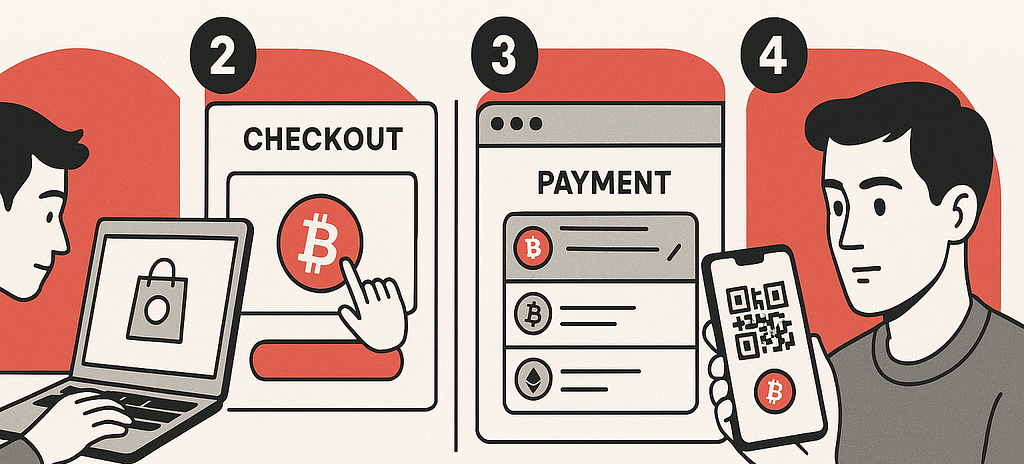

- The user selects the necessary product or service in your online store or marketplace;

- At checkout, they select a cryptocurrency as the payment method;

- The user chooses a specific cryptocurrency in the form directly on the site, or on the payment page of crypto payment gateway;

- They receive a crypto wallet link to pay for the order amount and pay (for convenience, a QR code with the seller’s details can be issued on the payment page).

Usually, payment is made automatically after several network confirmations within 10–20 minutes. Depending on the service, the customer is offered different available cryptocurrencies to pay for the order. Bitcoin, Ethereum, Litecoin and Tether (USDT) are among the most popular among such services now. In many cases, Fiat-to-Crypto Payment Facilitation plays a role behind the scenes by enabling users to move from traditional currencies into crypto before completing a transaction.

If your business needs a custom payment solution, working with a crypto wallet development company can help ensure compatibility and security. To streamline this process, businesses can integrate crypto payments on their website, allowing customers to pay using their preferred cryptocurrencies directly. Integrating the tools needed to accept cryptocurrency payments helps streamline checkout and improve user experience for digital-savvy customers.

How to accept crypto payments on website online in 2025

Accepting crypto requires a wallet with a public address. Gateways typically manage this securely on your behalf.

Using a Crypto Payment Gateway to Accept Payments

What It Is and How It Works

A payment gateway for crypto is a service that facilitates the transaction between your store and the blockchain.

There are many online cryptocurrency solutions for businesses, allowing them to accept crypto payments on websites without technical complexity.

Coinbase is one of the most popular as it allows you to accept cryptocurrency in store using it as a payment gateway and as a regular exchange. It helps to convert from Bitcoin into fiat without the need to request a withdrawal. The service is free on the first $1 million of transactions. Thereafter, Coinbase levies a merchant fee of 1% from then on.

If you want to accept BTC and other cryptocurrencies, you should pay attention to CoinPayments. This payment provider has an integrated cryptocurrency gateway and currently accepts more than 75 altcoins (cryptocurrencies other than bitcoin, such as Ethereum or DogeCoin), while charging only 0.5% as a transaction fee.

Among other popular cryptocurrency payment providers, it is worth mentioning BitPay and Cryptonator, the latter supporting (apart from Bitcoin) 10 altcoins, including Zcash and Dash.

CryptoCloud doesn’t charge for transactions (1% for withdrawal). An additional special advantage of CryptoCloud is the ability to accept crypto payment on the payment page. If a potential buyer does not have cryptocurrency in the wallet, he or she can quickly purchase it without going to other sites.

Role of the Payment Gateway

Gateways like Coinbase Commerce or CoinPayments:

- Generate payment addresses;

- Monitor blockchain confirmations;

- Notify your store when payment is complete;

- Optionally convert crypto to fiat;

- Provide tools to track transactions and generate reports.

Settlement Options: Crypto or Fiat

Once you add bitcoin payment to the website, you can choose how to handle the funds you receive.

Choose to:

- Receive crypto payments directly into your wallet and manage it yourself;

- Or have it auto-converted to fiat and settled to your bank account.

You can also choose to settle in stable assets to avoid major price swings while staying in the crypto ecosystem. The field of processing cryptocurrency payments is just beginning to develop actively, so at the moment there are not so many convenient services for making payments in cryptocurrency.

Key Features to Look For

- Supported cryptocurrencies;

- Settlement options (crypto or fiat);

- Transaction fees;

- Speed of confirmation;

- Reputation and customer support.

Best Crypto Payment Gateways for 2025

| Gateway | Supported Coins | Fees | Conversion to Fiat | Highlights |

| Coinbase Commerce | BTC, ETH, USDC, DAI | 1% after $1M | Yes | Instant conversion, great for startups |

| CoinPayments | 75+ altcoins | 0.5% | Optional | Low fees, great altcoin support |

| BitPay | BTC, ETH, USDC | ~1% | Yes | Easy fiat payouts |

| CryptoCloud | 10+ coins | 0% (1% withdrawal) | Optional | On-page purchase flow, user-friendly |

How to Accept Crypto Payments on Your Website

Step-by-Step Integration

Let’s consider the CryptoCloud service as one of the options for accepting payments in cryptocurrency.

Connecting to the service requires:

- Register an account – for this, you do not need anything other than an email address;

- Add a project to the system — in your personal account, you need to fill in some basic information about your project (link to the site, link to the successful payment page, etc.);

- Choose a connection method – through a ready-made add-on for your CMS (site content management system) or using a structured API;

- Set your wallet or settlement options;

- Test the payment flow;

- Go live and promote the new option.

With this setup, you’ll be ready to accept bitcoin payments on your website instantly.

Platform Examples

- Shopify. Use Coinbase Commerce or BitPay plugin;

- WooCommerce. CoinPayments, NOWPayments, BitPay;

- CS-Cart. CoinPayments or custom integration using API.

Integration Methods

- Plugins for Shopify, WooCommerce, Magento, CS-Cart, and others;

- API for custom-built integrations.

How to Accept Crypto Payments as a Business

Accepting crypto payments for business starts with setting up the right infrastructure for secure transactions.

Assess Legal and Tax Requirements:

- Research local laws on accepting cryptocurrency;

- Decide on business registration type for tax compliance.

Choose Your Crypto Payment Method:

- Set up a direct crypto wallet for manual transactions;

- Use a crypto payment processor (e.g., BitPay, CoinsPaid) for automated acceptance.

Set Up Your Infrastructure:

- Create a secure crypto wallet (hot for daily use, cold for storage);

- Open an account with a payment gateway and complete verification;

- Integrate payment options with your website or POS system.

Decide on Crypto or Fiat Settlement:

- Choose to hold received coins or set up auto-conversion to fiat currency;

- Consider custom conversion schedules based on cash flow needs.

Display Payment Options and Train Your Team:

- Clearly show crypto payment options on your site and in-store;

- Train staff on processing crypto payments and handling customer inquiries.

Monitor, Report, and Stay Secure:

- Regularly review transactions for accuracy and compliance;

- Implement strong security measures for wallets and access;

- Track all crypto transactions for reporting purposes.

Promote Your New Payment Option:

Announce crypto acceptance through your website, social media, and newsletters.

Testing and Implementing Crypto Payment Solutions

Before going live:

- Run test transactions;

- Set up error handling (e.g., expired transactions);

- Define refund policy (if supported);

- Optimize UX: display wallet address + QR code, email confirmation, etc.

Let’s consider examples of our clients on CS-Cart that have connected to crypto and improved conversions and the UX on their websites.

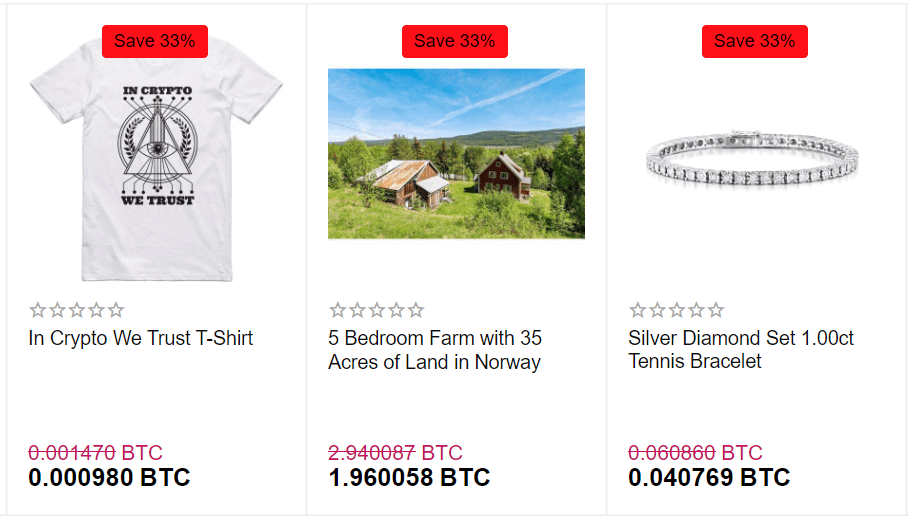

USE CASE 1: Pay with crypto on Crypto Emporium

Since 2019, the Crypto Emporium project consisting of a team of cryptocurrency experts and international procurement specialists, accepts payments in crypto for purchasing all kind of goods: from a diamond ring to a house.

We developed an add-on that enables the ability to display prices in cryptocurrencies and accept the payments via the Coinpayment crypto payment gateway.

USE CASE 2: Cryptocurrency support on Wimkle

Unique proposition of our marketplace is supposed to be the option to pay for all products in cryptocurrencies (for this bit we are already in the hiring stage of the company with main focus on the crypto space).

Wimkle project owner

We connected the Coinbase payment platform to the marketplace and reflected this new option on the storefront. This integration made it possible for vendors to seamlessly accept cryptocurrencies from buyers around the world.

Sellers can set their cryptocurrency payments at the moment of registration and earn Bitcoins or Ethereums by selling their products on the Wimkle marketplace.

Conclusion: Should You Accept Crypto in My Online Store in 2025?

If you’re running a modern eCommerce business, accepting crypto payments offers:

- Global reach;

- Lower fees;

- New customer segments;

- A future-ready brand image.

Also, due to the growing popularity of using cryptocurrencies, for many, the process of paying for products and services in Bitcoin, Ethereum and other cryptocurrencies is becoming familiar. By connecting crypto processing to online shopping in your project, you can significantly increase the conversion to payment and improve the financial results of your project. Embracing the ability to accept bitcoin payments online can further enhance the versatility of your payment options. Supporting alternative payment methods like crypto sets your store apart and improves the shopping experience for a broader audience. The ability to accept payments in cryptocurrency shows customers your store is innovative and future-ready.

With the right tools and a reliable tech partner, it’s easy to get started—and even easier to scale. Whether you’re targeting digital nomads, luxury buyers, or global shoppers, crypto payments could be the edge your store needs.

Ready to start accepting crypto payments?

Talk to our experts—we’ll help you choose the best payment gateway and set everything up.

FAQs About Crypto Payment Integration

Do I need a special license to accept crypto?

In most countries, no—especially if using a gateway that handles compliance.

Can customers pay with any cryptocurrency?

That depends on the gateway you choose; most gateways support multiple coins, allowing for a variety of payment options. However, it’s important to check the specific cryptocurrencies accepted by the gateway you select.

Is crypto legal in my country?

Check local regulations. In most regions, accepting crypto for goods/services is legal.