How much attention do you pay to marketplace payment solutions during online shopping? We bet a lot, as you can not ignore it.

In the era of technology, marketplaces are becoming extremely popular, as well as payment solutions for them, which are the most significant part of online shopping. Marketplaces must efficiently accept payments to cater to diverse customer needs and ensure smooth transactions.

Payment gateways are more than just a necessity of the purchasing process. It is one of the most critical indicators of customers’ confidence and loyalty in the store.

Assume that your marketplace payment gateway needs to look more reliable. It can cause a loss in customers, as they won’t trust the payment solution. Online payment gateways must be trustworthy for your store to succeed.

So today, we address the question of the best payment gateways for the marketplace and how to choose the right one for your marketplace.

What To Know About Payment Solutions For Online Marketplaces?

Purchasing products online should be secure, convenient, and accessible. Most of this relies on the online payments’ solution.

How to pay on the marketplace? That’s not a question a customer should ever have to ask. The marketplace payment process should be clear and easy to complete.

What Is A Marketplace Payment Gateway?

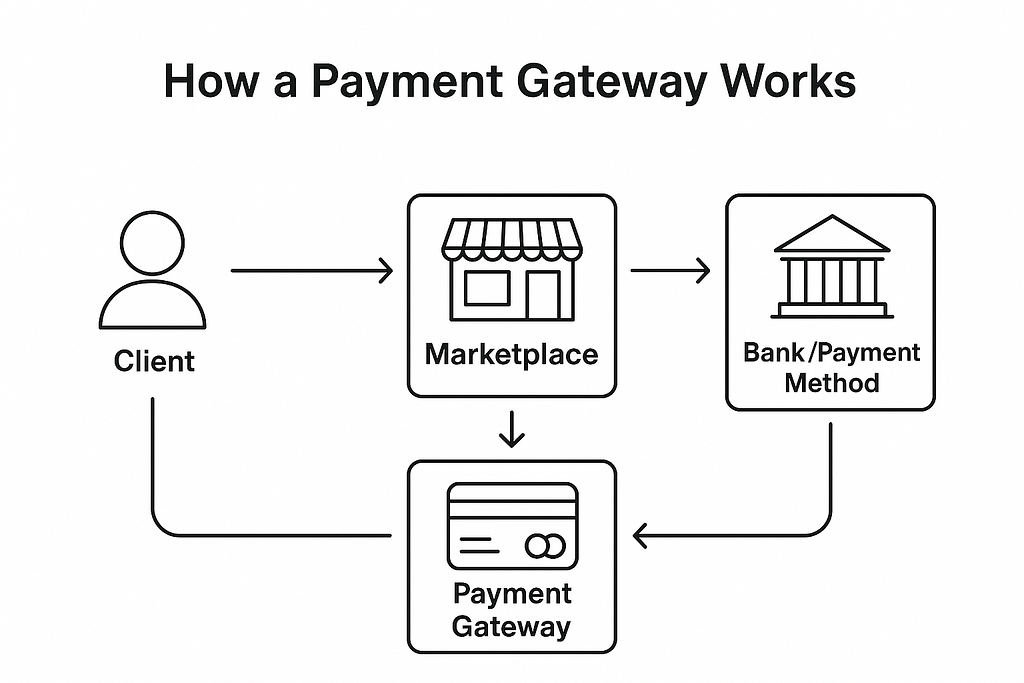

First, let’s define a payment gateway or payment solution for marketplaces. It is a tool that helps you process payments, monitor, and control all the payments on the platform.

How does it work? The payment gateway works as an intermediary between the client and the merchant. It transfers the information a customer provides on the marketplace to the bank or company that issued the card (or another payment method), receives the confirmation, and passes the money to the merchant.

For a customer, all these transactions are hidden. All the customer needs to do is enter their card information and confirm the transaction. That is why it is essential to ensure an online payment solution for the marketplace works fast, secure, and reliable.

Importance of Payment Gateways for Online Marketplaces

Payment gateways are a crucial component of online marketplaces, enabling secure and efficient transactions between buyers and sellers. A reliable payment gateway can make or break the success of an online marketplace, as it directly impacts the user experience, conversion rates, and ultimately, revenue. By integrating a payment gateway, online marketplaces can provide a seamless and secure payment experience for their customers, reducing the risk of cart abandonment and increasing customer satisfaction.

Ensure that your marketplace payment gateway is both trustworthy and efficient. Customers expect a smooth and secure transaction process, and any hiccups can lead to lost sales and diminished trust. Therefore, selecting the right payment gateway can significantly influence your marketplace’s growth and reputation.

What Are The Most Popular Online Payment Methods?

Before choosing the best payment solutions for the marketplace, you should understand your payment options or methods.

It is crucial to link sellers’ bank accounts for receiving payments, as various payment providers like PayPal and Adyen support transfers to bank accounts as part of their services.

There are three methods of payment the marketplace can use:

- Wire transfer. It allows accepting money through direct bank transfer.

Using wire transfer is cheap. Integrating the gateway to the marketplace is easy enough. However, bank transactions take a lot of time to process, not to mention it is impossible to get chargebacks, which are necessary sometimes.

- Custom payment solution. Development of a custom solution for the specific needs of your marketplace.

Although you can develop a perfect solution tailored to your needs, it will take a while. The development process is long-term work, requiring time, resources, and effort. So, a custom solution is only worth the investment if you’re building a long-term project with very specific requirements.

- Online marketplace payment solutions. Software that carries out transactions between the store and its clients.

Today, there are many third-party marketplace payments solutions you can easily integrate into your marketplace. You’ve probably heard of PayPal or Stripe. These are just a few examples of the top eCommerce payment solutions we’ll explore below.

Before, let’s consider two other marketplace payment options gaining popularity in 2025.

Cryptocurrency Payment Gateways

In addition to the three standard methods of marketplace payment processing, you can explore crypto payments.

Blockchain is gaining popularity largely due to the increasing demand for cryptocurrency payments. Moreover, blockchain payments are transparent and fast. No wonder entrepreneurs consider this option.

The essential advantage of the crypto payment system is payment processing with no financial institution participation. You do not need to wait for a transaction to be approved and processed by a third-party entity.

In terms of payments, blockchain records data related to accounts, such as transaction history and balance. For example, if two parties are members of a blockchain, and a transaction is added to the chain, payment can be authenticated by the parties and completed in seconds.

Blockchain payments are secure and efficient. They can automate the payment process and make it borderless. Among the popular blockchain payment solutions are Coinbase, CoinGate, and ALFAcoins.

We’ve got enough experience in connecting crypto payment systems. You can read about it further in our case studies:

- A Seller-Centric Marketplace with crypto payment options.

- CryptoEmporium: A Peer-to-Peer Marketplace with Crypto Payments

Secure payments are a crucial aspect of blockchain transactions, ensuring compliance with legal requirements and enhancing user trust.

Mobile Payment Solutions

Another method you should be aware of is mobile solutions. They are beneficial if you have an app for your marketplace or know that customers often use smartphones for online shopping.

Choosing the right payment service providers is crucial for facilitating real-time payouts and processing secure transactions within your marketplace ecosystem.

Mobile payments can be integrated through different ways, such as virtual wallets, third-party apps, P2P, and mPOS technologies. Mobile payment solutions have one great benefit — they provide valuable data. Through mobile payments, you instantly access the customers’ critical data, which helps determine their purchasing behavior. It allows you to provide more tailored offers to them and positively affects the overall customer’s journey.

One of the most popular payment processing platforms today is Apple Pay. It is an easy and secure way to pay for things in mobile applications, online, and in actual stores. If the user sets up the payment method as Apple Pay, he can pay within the app or even in Safari. In addition, the system is equipped with security features to protect the user’s data.

The Difference Between Single-Vendor And Multi-Vendor Marketplace Payments

How do single-vendor and multi-vendor marketplace payments differ?

Marketplaces can be single- or multi-vendor. The type of marketplace payment platform depends on the number of vendors provided on it.

- Simply said, on a single-vendor marketplace, customers buy products from suppliers. The owner of the market is also the one and only supplier. And it is only required on his part to provide payment details to receive money for purchased products.

- For multi-vendor marketplaces, it is a bit harder. As the name suggests, there are multiple vendors providing goods for clients. As the marketplace owner, you now have two sets of customers: merchants and buyers. Your marketplace using a two-sided model, the one Google and Amazon follow, is a platform for bringing those customers together. So the payment gateway should be convenient for both of them, especially for buyers who need to have the option of purchasing from several merchants at once and for enabling marketplace split payments between vendors and the owner. You also need to factor in your own commission, which adds complexity to the transaction flow.

All listed above should be considered when choosing the marketplace payment method.

Now that you know more about marketplace payments their features and capabilities, check out the best payment solutions in 2025.

Most Popular Marketplaces Payment Gateways in 2025

PayPal

PayPal is probably the most popular payment platform. It is also the oldest one (created in 1998).

Most modern marketplaces process payments as a fundamental aspect of their business model, and PayPal plays a crucial role in facilitating these transactions.

Among the main benefits of PayPal are the following:

- Availability. The platform operates in over 200 countries. If your marketplace is presented worldwide, it is one of the best payment gateways.

- Accessibility. For customers shopping on the marketplace, it is not necessary to have an account to pay with the system.

- High-level security. PayPal protects the data, as it doesn’t require clients to enter payment information such as credit card numbers.

Today, the system offers its marketplace payment solution: PayPal Commerce Platform. In addition, there are features for two-sided marketplace payments.

Can we name PayPal as one of the top payment solutions for marketplaces? Certainly.

Stripe

Another popular payment processing platform that is perfect for two-sided marketplaces.

Today, Stripe operates in over 45 countries. Stripe is known for its simple merchant onboarding. It only requires them to connect the accounts to the marketplace. As a marketplace owner, you are allowed to set a separate fee for every sale.

The one downside of the platform that could not suit you is that it is available mainly in the EU. So if you’re not in the region, you should look for another option.

We can highlight the following features of the payment solution:

- Marketplace vendors are the merchants of record (MoR). This means accepting payments for marketplaces and dealing with refunds and taxes is on the vendors’ shoulders. As the marketplace owner, you don’t have to control this.

- Possibility to choose an account type. There are three account options with different features, so you have more flexibility to choose the right one for your store.

- Stripe allows accepting multiple payments and supports more than 100 currencies, making it a solid choice for international marketplace payment processing.

Mangopay

Mangopay is a suitable payment option if you target the international market. As for now, it is trendy in Europe.

The marketplace payment service provider offers compliance with the European Union and card industry regulations, KYC, anti-fraud, and money laundering prevention tools to ensure your marketplace is a safe and reliable platform.

The platform offers payment processing solutions to crowdfunding and marketplace businesses.

What to highlight in Mangopay:

- Ability to customize payment flow. Mangopay allows building fully customizable payment flows through its API, making it ideal for marketplaces and crowdfunding platforms that need tailored transaction logic.

- Monitoring and reports. Mangopay provides robust real-time monitoring of all transactions and activities in real-time. You’ll find a detailed dashboard to track all your payments.

Braintree Marketplace

Braintree Marketplace actively and successfully competes with other paid software. It is a modern system for eCommerce platforms and mobile applications.

Braintree is available in 46 countries. The most significant advantage of the platform is split payments. The system automatically divides the merchants’ fees and sends commissions to the marketplace owner. It’s also good news that your vendors can perform as MoR in transactions.

Braintree has the following benefits:

- Braintree is a very technological solution. It has advanced software development kit features and high-level security compliant with PCI DSS.

- It could be integrated with PayPal. So users with PayPal accounts can still quickly go through checkout on your marketplace based on Braintree.

Dwolla

Dwolla is a US-only payment provider, specifically designed for ACH transfers within the United States. The payment platform is developed specifically for eCommerce projects and easily handles payments for two-sided marketplaces.

With this system, the marketplace owner has to be the MoR and take all the related responsibilities.

The features of Dwolla:

- Free trial. You can set up Dwolla for free and see if it meets your requirements. It is a great chance to try the solution first.

- Automated Clearing House transfers support. It is an American network that provides transactions among banks. So you receive hassle-free financial transactions. And using ACH is free.

- Dwolla has developer-friendly documentation and clean API, so there won’t be issues while integrating the platform.

Adyen MarketPay

Adyen is a secure and globally used payment system, operating in nearly 100 countries across Europe, Asia, and beyond. The platform is flexible, functional, and secure. Safety is one of the major benefits of Adyen. It is equipped with a Revenue Protect toolkit, which has proven its efficiency against fraud. This particular solution ensures that the customers’ credit card information is safe.

Among other Adyen’s features are the following:

- Support of bank transfers in 180+ currencies and over 250 payment methods.

- Adyen allows for custom payment flows that can be easily set up on your end.

- The system provides automated vendor onboarding, KYC, AML, and other vendor screening and fraud prevention tools.

We’ve connected lots of payment gateways for our clients, including various payment service providers. Adyen was one of them. You can read further about it in one of our case studies.

Exactly

Exactly is a versatile payment system designed for eCommerce and online businesses. It offers global reach with support for 150+ currencies, making it ideal for international transactions. The platform emphasizes security, flexibility, and customization to empower merchants in scaling their operations.

Key Features:

- Real-time payment processing and currency conversion.

- Support for major cards (Visa, MasterCard) and alternative methods (PayPal, Apple Pay).

- Recurring billing, customizable invoices, and payment links.

- PCI DSS compliance, 3D Secure, and advanced fraud detection.

- Multi-language support and analytics tools for transaction insights.

This platform is well-suited for online businesses targeting a global audience. It is particularly beneficial for companies that require recurring billing or subscription management software. Additionally, merchants seeking quick integration and customizable payment forms will find it advantageous.

On the downside, the platform may be complex for small businesses that are unfamiliar with advanced features. Furthermore, there is limited information available regarding pricing transparency, which could lead to uncertainties for potential users.

Square

Square operates in 8 countries including the US, Canada, Australia, Japan, the UK, Ireland, France, and Spain. It offers POS hardware, mobile payments, and offline mode, making it ideal for retail and food services. Designed for small companies, Square provides flexible hardware and a free plan with essential point-of-sale features.

Key Features:

- Accepts payments via credit cards, mobile wallets (Apple Pay, Google Pay), QR codes, and BNPL services.

- Offers eGift card creation, inventory management, and sales tracking.

- Hardware options include mobile card readers and touch-screen registers.

- Offline mode for payments without Wi-Fi and instant fund transfers.

This solution is ideal for small businesses such as food trucks, retail shops, and restaurants. It caters to merchants looking for low-cost startup options with scalable hardware solutions. Additionally, businesses that require integrated payroll or loyalty programs will find it beneficial since Square integrates with Homebase payroll software among other solutions.

However, there are some downsides to consider. The platform has higher transaction fees compared to competitors, charging 2.6% + $0.15 for in-person transactions. It also lacks compatibility with Windows devices and does not offer a training mode for onboarding new staff, which may pose challenges for some businesses.

Comparison of Top Marketplace Payment Gateways in 2025

How To Choose The Right Payment Solution For An Online Marketplace?

| Payment Gateway | Countries Supported | Best For | Key Features | Avg. Fees |

|---|---|---|---|---|

| PayPal | 200+ | Global marketplaces | Buyer protection, PayPal Commerce Platform | Varies by country |

| Stripe | 46 | Multi-vendor platforms | Split payments, 100+ currencies, easy onboarding | ~2.9% + $0.30 |

| Adyen | ~100 | EU/Asia marketplaces | 250+ methods, KYC/AML, Revenue Protect | Custom pricing |

| Mangopay | 200+ | Marketplaces, crowdfunding | Custom flows via API, real-time monitoring | Custom pricing |

| Braintree | 45+ | Apps, SaaS platforms | Split payments, works with PayPal | ~2.9% + $0.30 |

| Dwolla | US only | US-based marketplaces | ACH transfers, developer-friendly API | Low fixed fees |

| Square | 8 (US, CA, AU, JP, EU) | SMBs, retail & offline use | POS hardware, mobile wallets, offline mode | 2.6% + $0.10 (US) |

| Exaclty | Global | Custom solutions | Flexible integration, advanced analytics, multi-currency support | Custom pricing |

When the best payment gateways are listed, how do you know which one is right for your marketplace? Take a thorough analysis before you choose an optimal solution for your business.

There are several things that you can do to make the right decision.

- Check market availability. You should know all the markets where your business will be operating. So check the availability of the payment solution there first. And remember to check what currencies the method can process. The more currencies and countries supported, the more flexibility you’ll have in scaling your business.

- Security level and compliance with standards. A payment gateway should comply with specific regulations and laws. And there is a whole list for this. Checking it beforehand will protect you from errors and fraud.

- Support for mass payments. The marketplace is the place where people pay for several orders at once. The payment method you choose should ensure they can do this easily.

- Features set. Decide on the primary functionality beforehand and check the gateways to meet your requirements.

- The ease of integration. One of the most significant factors is the implementation of the system. While most of the solution provides SDKs and APIs to integrate them, it also can take time and requires a fellow developer.

To accept payments efficiently, consider these factors to ensure smooth transactions and customer satisfaction.

Factors to Consider When Selecting a Payment Gateway

When selecting a payment gateway for an online marketplace, there are several factors to consider. These factors will help ensure that the chosen payment gateway aligns with the marketplace’s needs and provides a seamless payment experience for customers.

Fees and Charges

The fees and charges associated with a payment gateway can significantly impact the profitability of an online marketplace. Payment gateways typically charge a percentage of the transaction amount, as well as a fixed fee per transaction. Online marketplaces should carefully evaluate the fees and charges of different payment gateways to ensure they align with their business model and revenue goals.

For instance, while some payment gateways may offer lower transaction fees, they might charge higher fixed fees per transaction, which could add up quickly for marketplaces with a high volume of low-value transactions. Conversely, gateways with higher transaction fees, but lower fixed fees might be more suitable for marketplaces with fewer, higher-value transactions. Understanding these nuances is crucial for optimizing costs and maximizing profitability.

Supported Locations

Online marketplaces operating globally need to ensure that their payment gateway supports transactions in multiple countries and currencies. Payment gateways may have restrictions on the countries and currencies they support, so it’s essential to choose a gateway that meets the marketplace’s global requirements.

A payment gateway that supports a wide range of currencies and countries can help an online marketplace expand its reach and cater to a diverse customer base. This is particularly important for marketplaces looking to scale internationally, as it ensures that customers from different regions can complete transactions in their local currency, enhancing their shopping experience and increasing the likelihood of repeat business.

Number of Payment Options

Providing multiple payment options can increase customer satisfaction and conversion rates. Online marketplaces should consider a payment gateway that supports a wide range of payment methods, including credit and debit cards, digital wallets, and local payment methods. This can help cater to a diverse customer base and increase the chances of successful transactions.

Customers expect flexibility in how they can pay. By offering a variety of payment methods, online marketplaces can accommodate different preferences and increase the likelihood of completing sales. For example, some customers may prefer using e-wallets like Apple Pay or Google Pay, while others might opt for traditional credit or debit card payments. Additionally, supporting local payment methods can be crucial for penetrating specific markets where certain payment methods are more prevalent.

By carefully evaluating these factors, online marketplaces can select a payment gateway that meets their specific needs and provides a seamless and secure payment experience for their customers.

Marketplace Payment Trends In 2025

Remember to check the current payment trends, especially in online payments, when choosing the payment solution for your marketplace. Such trends significantly impact the eCommerce industry, and keeping up with them helps businesses to stay ahead. So, what current trends can you implement into your payment systems?

Super-Apps

They are simultaneously gaining prominence as comprehensive marketplace hubs where users can access multiple services and make purchases without switching between applications. These platforms integrate various functionalities—shopping, payments, messaging, and more—creating self-contained ecosystems that keep users engaged and spending. For marketplace operators, super-apps represent an opportunity to increase customer retention and transaction frequency by providing a one-stop digital destination.

Embedded Payments

They have emerged as a critical component for marketplace success in 2025, representing a significant shift from traditional payment processing to seamlessly integrated financial experiences. Embedded payments are often powered by integrated payments infrastructure, creating seamless experiences for users. Merchants implementing embedded payment solutions within marketplaces are experiencing substantial improvements in business performance, with conversion rates increasing by 5-12% and average cart values rising by 15-30%. This transformation reflects the growing consumer demand for frictionless checkout experiences that minimize steps and maximize convenience.

QR-code payments

QR-code payments became the popular solution for many things during and after the pandemic, including contactless payments. A safe and easy method can be used in offline points of sale and on the marketplaces. For instance, customers can scan QRs with their phones and automatically complete the purchase via Apple Pay.

Buy Now, Pay Later (BNPL)

This trend continues growing, with 51% of global consumers having used these services as of 2024 according to Global Newswire. Marketplaces integrating BNPL are witnessing higher average order values and improved conversion rates, particularly among younger consumers who prefer these solutions to traditional credit cards. The low regulatory barriers and persistent inflationary pressures have further accelerated BNPL adoption, allowing marketplace shoppers to bypass conventional credit channels. Read more about BNPL.

Pay-by-bank options

Powered by open banking frameworks, they represent another significant trend reshaping marketplace payments. These solutions enable direct account-to-account transfers that are both swift and cost-effective for all parties involved. The implementation of regulations like the Instant Payment Regulation (IPR) is further driving adoption of real-time bank transfers, creating opportunities for marketplaces to reduce transaction costs while improving user experiences.

One-Click Payment

Such experiences have emerged as an innovation for marketplaces, dramatically reducing cart abandonment rates. While traditional multistep checkout processes see abandonment rates exceeding 70%, one-click solutions bring this figure down to under 1%. This improvement is particularly pronounced in mobile shopping environments, where streamlined checkout processes directly translate to higher conversion rates.

AI Tools

Being deployed across the payment lifecycle to enhance fraud detection, they personalize checkout experiences, and optimize payment routing. For marketplace operators, AI presents opportunities to improve conversion rates through intelligent payment method selection and reduce costs through more effective fraud prevention.

The Use Of Crypto Payment Gateways

These technologies offer marketplaces enhanced security, reduced transaction costs for cross-border payments, and new ways to engage tech-savvy consumers.

Digitalizing B2B payments

Even in the 21st century, paperwork remains prevalent, especially in B2B payments, expense reimbursements, and accounts payable. Digitizing these processes—for example, through accounts payable automation software—can benefit marketplace owners and vendors. Remote tools enhance visibility into money flows, showing where funds go. This enables cash flow optimization, reduces errors, and helps mitigate fraud.

How To Integrate The Payment Solution Into Your Marketplace?

Usually, there are two methods to use: widgets and APIs.

- The system itself provides widgets. You need to integrate the solution into your marketplace, and the system will handle the security and storage. For example, Stripe is one of the methods that provide widgets.

- With API, it is more complicated. You are responsible for the data storage and money transfer to the vendor. There is a need to pass the PCI DSS certification. What is more, the resources are needed to create a solution for secure data storage and secure payments.

To Sum Up: The Best Payment Gateways to Scale Your Online Business

As you can see, there are many good payment gateways for processing payments in marketplaces. Of course, every option has its pros and cons. However, choosing the suitable transmitter for your business can become a crucial step in its success.

Here are several tips: if you plan to go internationally, select Stripe or PayPal, concentrating on the US – Dwolla and Braintree are the choices for you, and for European markets, Adyen and Mangopay are the perfect solutions. If you want to go beyond and accept cryptocurrency, consider blockchain payment methods.

When choosing the payment gateway, remember to choose your partner, who should help you provide the perfect for your customers. And with the marketplace, you have to satisfy the experience of both clients and vendors. So focus on security, reliability, and ease of integration. This way, you will succeed in selecting the proper payment method for the marketplace.

FAQ about Payments for Marketplaces

A payment gateway is software allowing you to automate the marketplace payment processing. It is an intermediary that transmits money from the marketplace customer to its vendors. All the processes are happening online.

It provides you with payment process automation and ensures your customers have the best shopping experience.

There are tons of options nowadays. Among the best ones are PayPal, Stripe, Dwolla, and Braintree, efficient solutions for the international marketplace. The most popular transmitters among mobile solutions are Google Pay and Apple Pay.

There are several features you should pay attention to:

– Availability in your region and the market you are planning to operate;

– Compliance with laws, standards, and regulations;

– Mass payment and tax reporting tools;

– Ease of integration, and availability of developer-friendly documentation.